I've been slowly gathering up my 2019 financials so I can get around to my taxes in a week or two. I'm in no hurry, because I am not anxious to see if my effective tax rate has gone up again. One thing I noticed just this evening is that I've gone from spending hundreds each year in credit card interest charges... to spending nothing in 2019.

I've been slowly gathering up my 2019 financials so I can get around to my taxes in a week or two. I'm in no hurry, because I am not anxious to see if my effective tax rate has gone up again. One thing I noticed just this evening is that I've gone from spending hundreds each year in credit card interest charges... to spending nothing in 2019.

That's a first.

And a far cry from 2015 where I averaged paying $45 in fees per month and getting nothing in return.

Money is expensive, y'all.

Turns out that paying off my credit cards and then working hard to keep them paid off month-to-month was worth the rather painful lifestyle changes it took to get here.

No idea where all the money I saved in credit card interest has gone... probably to my mortgage... but so long as it's going towards something instead of nothing, I'm happy.

I'd be a lot happier if I had that money in cash so I could roll around in it... but still...

Aquiring a mortgage and other massive expenses makes it so that I really have to watch where my money goes. One of the best tools I've found for that is the "pro" version of the TrueBill app on my iPhone. For $3 a month, the app helps me to track my spending and plan for expenses, all while keeping me on top of my bills and credit cards. It also makes it easy for me to squirrel away the money I save for my Black Friday Shopping day... and my vacation. It's surprising just how helpful it's been and I wish I had started using it earlier.

Aquiring a mortgage and other massive expenses makes it so that I really have to watch where my money goes. One of the best tools I've found for that is the "pro" version of the TrueBill app on my iPhone. For $3 a month, the app helps me to track my spending and plan for expenses, all while keeping me on top of my bills and credit cards. It also makes it easy for me to squirrel away the money I save for my Black Friday Shopping day... and my vacation. It's surprising just how helpful it's been and I wish I had started using it earlier.

One of the things that surprised me most after tracking expenses was how much I was spending on groceries. I knew they're expensive every time I end up at the store. What I didn't expect was how much it was all adding up to. The monthly total was staggering and caught me off guard when I saw it. A trip here... a trip there... the amount going towards groceries was absurd.

That's when I started buying generic or store brands instead of name brands... making my own meals instead of buying prepared... and, of course, only buying something when it was on sale (unless I had no choice). In short order I had cut my grocery bill by 30%. After a while I was pushing 40% because I got smarter about buying ahead, freezing, not buying stuff I don't need, and hunting down sales and specials.

And then there was eating out at restaurants.

I used to eat out at least twice a week. Sometimes much more when work was piled up. Which, this time of year, is often. I never gave it a thought. I never kept track. I never kept a total. But TrueBill put the expense in vivid relief. If the money I was spending on groceries was surprising, the money I was spending on restaurants was downright shocking. Once I had it spelled out for me, I stopped eating out.

From there it was only a short reach to canceling magazine subscriptions, cutting cable, and reducing the amount of money spent on entertainment.

So now, all these months later, I've gone from having absolutely nothing at the end of the month and wondering where all the money went... to not having to stress so much and being able to set aside a few bucks for when unexpected expenses come up. Which is almost certain to include a new water heater or (shudder) a new HVAC system one day all too soon.

It's a far better feeling than I ever got from the money I was tossing at things I didn't need to be spending it on.

All it took was finally taking a look at what I was spending. And finding an app to help me do it.

And... my one shopping day of the year is here! Every month I put aside $100 for clothes and "other stuff" then wait until Black Friday to buy all the clothes and "other stuff" I need. $100 a month is quite a chunk of cash to not have in my pocket, but worth it when I end up with $1200 in November that magically becomes $2400 (or more!) on Black Friday thanks to all the sales and savings.

And... my one shopping day of the year is here! Every month I put aside $100 for clothes and "other stuff" then wait until Black Friday to buy all the clothes and "other stuff" I need. $100 a month is quite a chunk of cash to not have in my pocket, but worth it when I end up with $1200 in November that magically becomes $2400 (or more!) on Black Friday thanks to all the sales and savings.

Below I refer to "Rakuten Cash Back" in a lot. Rakuten bought out eBates and have taken over their cashback operations. It's a pretty easy way to save even more money on Black Friday (or any other day) and you can sign up to get $10 right off the bat with my referral link right here.

And now? On with my Black Friday scores...

AKASO DASH CAM! • Reg. $66, Paid $38 (after Amazon cash back)

My previous dash cam was $20 and has lasted for four years before falling apart and going glitchy. As I mentioned, I am afraid to drive without one given how crazy distracted drivers are, so I was hoping hoping hoping I could get a nice one on sale. I was going to buy another $20 camera, but the cheap ones force you to remove the tiny memory card every time you want the footage. With a WiFi model like this you can just connect with your iPhone and grab the video directly. Handy! Plus... GPS! Worth the additional $18.

SHOES! • Reg. $170, Paid $128

I should have bought shoes last Black Friday, but I thought I could get one more year out of the pair I have. I'm not rough on shoes... they usually last me four or five years... so a little Shoe Goo will keep them together right? They still look great... it's just the soles that are falling apart. But back in August the soles fell complete apart. My plan was to buy a cheap pair of $20 shoes, rip the soles off, then glue them on mine. This seemed extreme. Instead I used more Shoe Goo to piece everything together. It worked surprisingly well. But I needed new shoes. I would have loved to have found the same model I had before... but of course shoe companies don't do that. I also would have loved to have spent under $100... but of course the shoes I found that I liked weren't under $100. Oh well. It's still 25% off, which is better than nothing.

ALEXA!

Reg. $99 • Paid $33 (with trade-in and Amazon cash back)

I bought a SONOS One for my bedroom. It's absolutely fantastic, and fills the room with amazing sound. Problem is, the AirPlay 2 on it is glitchy as hell, which means the audio has constant drop-outs when I'm playing content from my Apple TV. And Apple TV keeps "forgetting" that the SONOS exists, so I am having to reconnect several times a week. It's maddening, because 95% of the time I'm using it for my television. And so I decided to get an Echo (3rd Gen.) which has a 3.5mm audio line-in that I can run directly from my television. I traded in the old Amazon Echo I have in the bathroom for $25, so it ends up being a $35 spend. No, the sound won't be as good as my SONOS One, but it's gotten good reviews for its quality and will be good enough... plus I can transfer the SONOS One to my upstairs bathroom, which will be amazing for listening to music each morning while I shower and get ready.

iTUNES! GIFT CARD • Reg. $100, Paid $70 (with Rakuten Sign-up Bonus)

As is my custom every year, I buy a $100 iTunes gift card at 20% off to cover the Marvel movies and sale movies I buy each year. I joined Rakuten and they gave me $10 cash back for my first purchase, so this year it was an especially sweet 30% off!

OUTDOOR NEST CAM! • Reg. $199, Paid $159

I have two camera systems. A wired system with local recording that has a battery backup and will run even with no power or internet... and a Nest cloud system which is constantly uploading footage to the internet. The Nest cameras are fantastic, but I was ready to ditch them all because the per-camera cloud service cost was absurdly expensive. But they made an announcement a while back that this would be changing to a much cheaper "bulk plan" where all cameras would be covered for one price. Given this, I decided to keep all my Nest cameras and replace a failed outdoor camera with another Nest. But not the new "Nest Cam IQ" which has the stupidest mounting requirements (DRILL A HOLE THROUGH YOUR HOUSE!), I got the original Nest Cam Outdoor. I budgeted to get it for $129, but the savings ended up being less steep than I had hoped.

HELLO! • Reg. $229, Paid $149

The first smart doorbell I had was the original "Ring" model. It was huge, but it worked well. Then Ring sent me an offer I couldn't refuse... a 4th generation smaller "Ring Pro" model upgrade for a fraction of the retail price. Sadly, it has never worked as well. But an even bigger problem with Ring is that it is SO slow. By the time they notify you that somebody has rang your doorbell, they've long gone. And trying to review the cloud footage is futile because it takes forever for it to upload and be available. Since my Nest cloud cameras are always available instantly and very quick to notify, I've wanted to get a Nest Hello doorbell replacement. Now that Google Nest is having a bulk deal on cloud services for multiple devices come 2020, this was a no-brainer.

PRESSURE COOKER! • Reg. $120, Paid $35 (after Rakuten cash back)

I already mentioned this one earlier this week. Thanks to a goof by a website (they switched the sale prices of the 6-quart and 8-quart for half-a-day) I finally got an Instant Pot (or, to be more accurate, an Instant Pot knock-off) for $35. SCORE! I bought this as a flawless egg cooker, but have ended up using it for lots of stuff. Not something I had planned on buying (or had budgeted for) but I was happy to find it.

UNDERWEAR! • Reg. $102, Paid $46 (after Rakuten cash back)

Half of my skivvies are literally falling apart. But I keep wearing them and repairing them because I need enough that I can do full loads of laundry. Fortunately, Old Navy had an EVERYTHING IS 50% OFF SALE plus free shipping on orders of $50 or more. I was able to get 10 pair of quality underwear, some socks, and a couple pair of touch-screen-friendly gloves for $51. Old Navy tends to hold up pretty good, so that was money well-spent. Especially since I earned $40 in SuperCash I can spend on more Old Navy, plus $5 cash-back from Rakuten, which means I am essentially getting all this for $6?!? (assuming I spend the $40).

CLOTHES! • Reg. $947, Paid $367 (after Rakuten cash back)

My favorite jeans, hands down, are Banana Republic slim-fit. They are comfortable, look good, and (most importantly) they last forever. Seriously, I have jeans from four years ago that look new. Unfortunately, my American Eagle jeans do not hold up as well and are needing to be replaced. I took Banana Republic up on their 50% off Black Friday offer and buy four pair. With the Rakuten cash back, they're knocked down to $41.25 a pair! SCORE! Then I headed over to The Gap and Banana Republic Factory for some dress shirts, T-Shirts, casuals, and gloves at 60% off off $480 plus $20-something in Rakuten cash back. Not too shabby.

Grand total? $1025 spent for $2032 in merchandise. Or almost exactly 50% in savings. With tax adding $82, my total spend this year was $1107. So... woohoo! I've got $93 left!

I should keep it in the bank and roll it over for next year... but... the LEGO Jurassic World video game for Nintendo Switch is on sale for twenty bucks!

I guess I'll just blow the remainder on cocaine and hookers. Does anybody know where I can find cocaine and hookers for $70?

And so there it goes. I now have enough new clothes and toys to last me until next Black Friday. And until then... time to start squirreling away another $100 a month. Which never seems like much fun until today.

Ignore me if you will, but this is a subject that means something to me.

Ignore me if you will, but this is a subject that means something to me.

Credit card debt is a pariah that will consume you. And now that interest rates are going to increase past the already absurd rates that credit card companies charge (thank you Federal Reserve!), it's more important than ever to get yourself out of credit card debt if you have any. Large balances are designed to keep you paying high interest charges forever, without ever fully paying off your debt. It's a trap... and it's really tough to get out of once you're caught in it.

I know this, because I've been there.

During my two years in college, I accumulated huge debt. Huge.

I wasn't working very much because of school and travel (and partying), but was spending as if I were a CEO. First it was one credit card. Then it was another. Then it was another. It took *decades* for me to climb out of it. Years of barely being able to make payments. Years of getting nowhere in paying off my balances. Once I realized the thousands of dollars being blown every year on interest, I started focusing on paying off my cards. It was hard. Very hard. I'd buy nothing but the bare minimums I needed to survive. I wore clothes until they fell apart. I'd do any activity on a shoestring budget and limit expenditures any way I could. It took years of this, but eventually I clawed my way out.

And I have made it my mission to pay off my balance every month ever since. Sometimes there are emergencies. Sometimes I haven't saved enough for vacation and it takes a couple months. But I work very hard to not spend money I don't have so I can pay off my balance every time.

There are a lot of ways to get help if you need it. Apps that help you set payment goals. Books on financial planning. Websites with great advice on how to get out of credit card debt. And, if you are really in deep, financial advisors that can come up with a plan and negotiate with banks to get interest lowered... or help you find a loan. But however you mount your attack on credit card debt, it's hugely important that you start immediately. Our own government is working with banks to enslave you with debt, and it's only going to get worse. Much worse. The sacrifices needed to escape their clutches are hard ones to make, but ultimately worth it.

I honestly don't know what the future holds with our Federal Reserve manipulating things the way they have been. They don't even bother hiding it any more. This country is now designed exclusively for the wealthiest among us. That may not be you, but finding freedom amongst the ruins is a goal worth having.

Good luck to you.

Good luck to all of us.

We need it now more than ever.

Temperatures finally breached 100° this week, so the air conditioner had to be turned on. Darnit. Odds are it's going to stay on because the forecast is up there for the next ten days. Probably longer.

Temperatures finally breached 100° this week, so the air conditioner had to be turned on. Darnit. Odds are it's going to stay on because the forecast is up there for the next ten days. Probably longer.

So much for tiny electricity bills.

Even though I set the temperature between 74° and 76° and use ceiling fans, it's a goodly chunk of money to keep everything in the house from melting.

Including the cats.

And then...

Back in 2015 when Apple released the latest and greatest 4th generation Apple TV, I purchased one to replace my aging 2nd generation unit (which I moved to the guest room). Despite the remote being shit, I was happy with the upgrade. At first. Eventually I found out that the unit had horrible problems streaming video from Apple. Other sources... Netflix, HBO, Showtime, YouTube, Hulu, you-name-it, were all working fine on Apple TV, it was just my iTunes Store purchases that were stuttering and crapping out... or not loading at all.

So when I ended up winning a second Apple TV from an incentive give-away, I just tossed it in the closet. My bedroom TV has Netflix built-in, so I figured I'd just wait until somebody came up with a hack to turn the Apple TV into a web server or something. Since it had problems streaming my rather large collection of Apple media, it just wasn't worth messing with.

Until Game of Thrones Season 7 was announced to be arriving.

My bedroom TV doesn't have an HBO app, so I decided to dig out the extra Apple TV so I can watch Thrones in bed as God intended.

But first I had to find the thing, because I had no idea what happened to it during the move. I've been searching off and on for weeks to no avail. And then this morning I finally found it.

By accident.

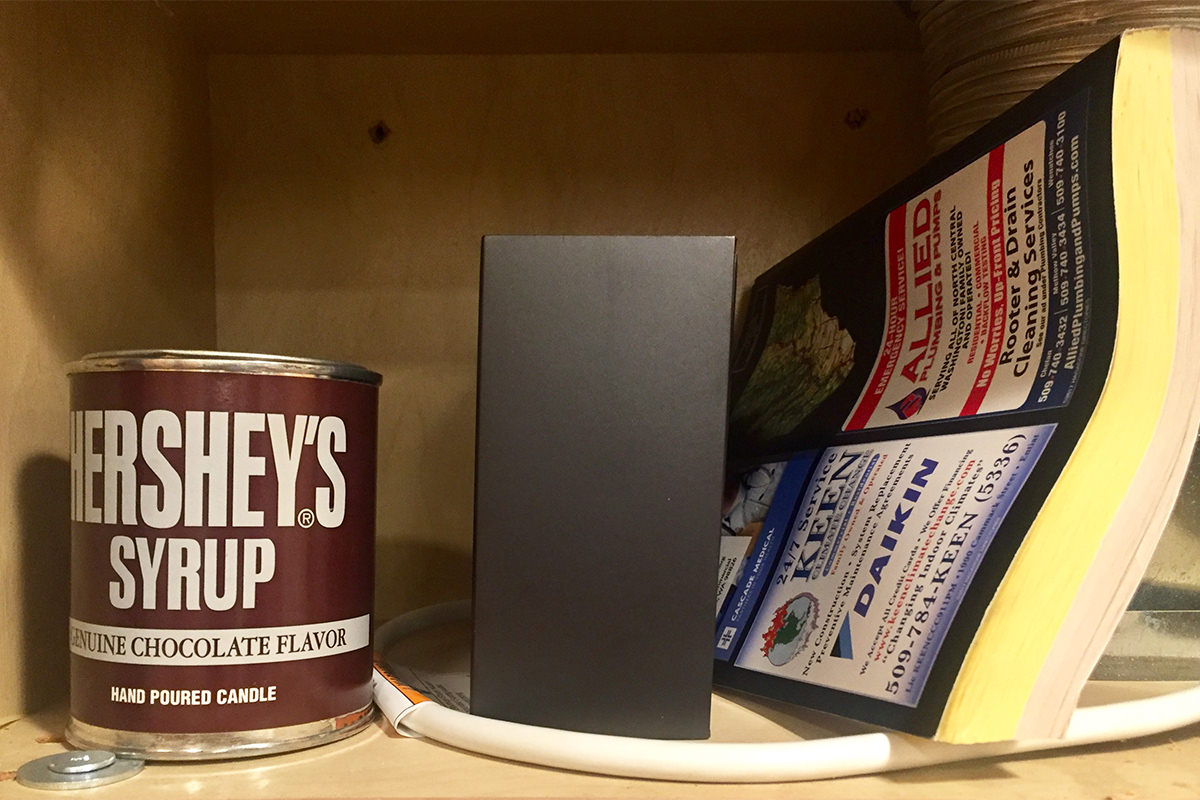

My cats have been acting crazy, so I decided to start putting my iPhone charging cable in the tiny empty cupboard above my range hood and microwave where they couldn't get to it... and... voilà...

My "empty" cupboard contained an old phone book, a Hershey chocolate candle, and... my missing Apple TV. In all honesty, I do not remember putting it in there. I don't remember putting any of it there. I can't even think of why I'd have done it.

Probably so I wouldn't lose it?

Jenny helped me set it up...

And... ready for new Game of Thrones on the 16th!

The reason I want to be obscenely wealthy is not to buy a bunch of expensive crap.

The reason I want to be obscenely wealthy is not to buy a bunch of expensive crap.

If a billion dollars were to suddenly drop in my lap, I don't know that I would get a new house. Or even a new car. Living in a palace and driving a Ferrari just don't interest me. Neither does accumulating a lot of expensive crap. So long as I can afford a laptop, a nice camera, and an iPhone... I'm pretty much done.

No, the reason I want to be obscenely wealthy is so I don't have to work and can spend the rest of my life traveling the world.

Not that I haven't found a way to travel the world now... but there are experiences that require time and money I will never have that haunt my travel dreams.

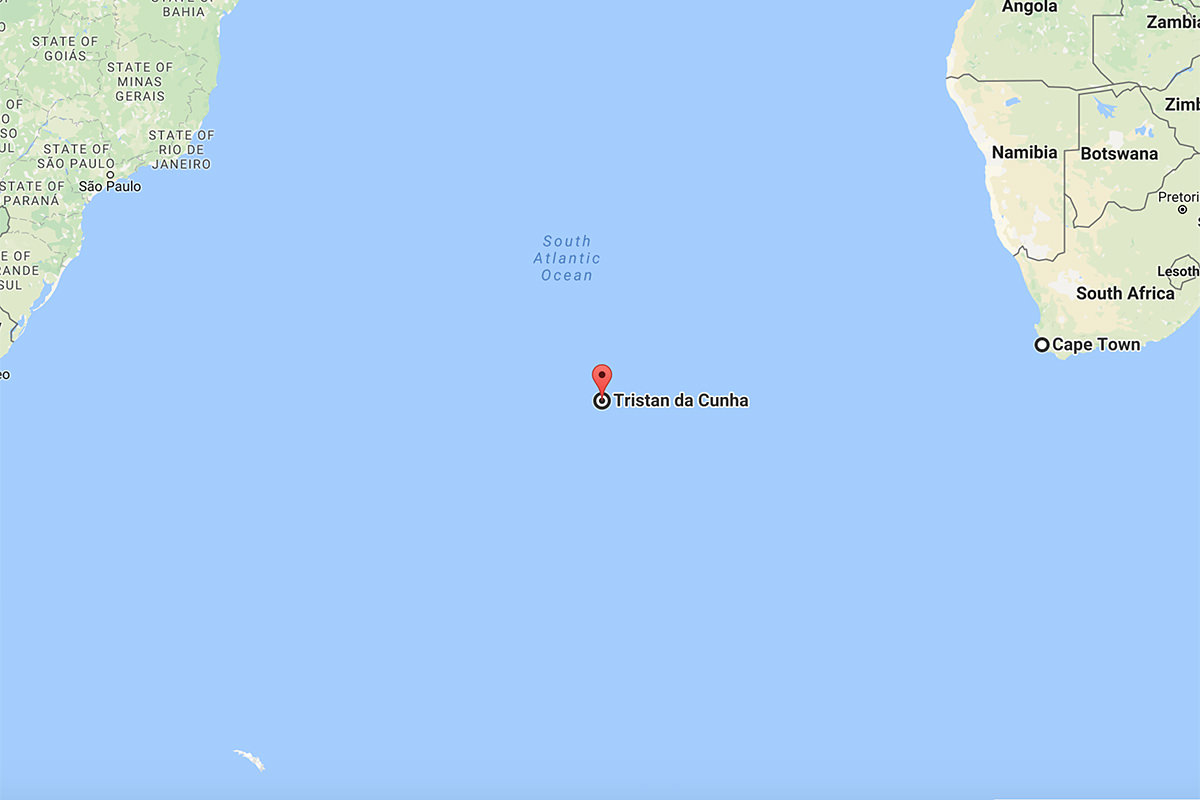

Take, for example, Tristan da Cunha

Located in the middle of nowhere in the South Atlantic, this small island is one of the most remote places on earth...

It's so remote that the only way to get there is by ship. Which takes six days.

Luckily, ships are making runs to Tristan da Cunha somewhat monthly out of Cape Town (though the dates of departure/return are not set in stone and can move depending on numerous factors). The return passenger fare is under $700 USD, which is a pretty decent price, all things considered. I would not count on luxury digs, however, as the two ships currently making the run are a fishing ship and a cargo ship.

And there's more!

Space on the two ships is limited. And non-resident tourist passengers have the lowest possible priority. If somebody is sick and needs to get off the island for medical reasons? You get bumped. If somebody on official island business needs to leave at the last minute? You get bumped. If somebody on the island decides they want to holiday in Cape Town? You get bumped. What this means is that you can schedule a trip to arrive at Tristan da Cunha on May 22nd then return to Cape Town on May 28th... and end up leaving on June 2nd and returning August 23rd (or longer!).

So to visit, not only do you need to have the time and money to sit around Cape Town waiting for a ship... you also have to have the time and money to sit around Tristan da Cunha waiting for a ship.

OR... you can try to book a cruise ship.

Apparently there are cruises that sail the South Atlantic from time to time. They run between Ushuaia (South America) and Cape Town (Africa). They last two weeks and cost over ten thousand dollars... so, again... time and money required.

OR... if you're a billionaire?

I'd imagine you could go wherever the hell you want. Charter an entire ship to get to/from Tristan da Cunha if you want to. The world is your oyster.

And that's the reason I want to be obscenely wealthy.

Tuesday is the toughest day of the week for me. If anything is going to go wrong, today is the day.

Tuesday is the toughest day of the week for me. If anything is going to go wrong, today is the day.

In this case, it was having a pile of work left over from Monday while I'm having to reschedule three flights. Which wouldn't be so bad if it weren't for the heinous change-fees that airlines like to charge now. I had to pay anywhere from $125 to $200... plus the change in airfare. Which always seems to increase, by the way. Kind of crazy how having your plans change can be so absurdly costly.

Just one more reason I frickin' loathe to fly any more. Even if you manage to get a decent fare, you still end up screwed if something comes up. And when you fly dozens of times a year, stuff is gonna come up.

Oh well.

It's not like I need to pay rent. Or eat. Or buy toilet paper.

Good thing I gave up taking a shit for Lent.

During the "Dot Com Explosion" of the late 90's I knew more than a few people who amassed considerable wealth in a very short amount of time. This did not include me, however, because I was becoming increasingly involved with the Buddhist studies I had stumbled upon a decade earlier. Material wealth was something that took a distant back seat to my spiritual wealth back then, so chasing the buckets of money was not a priority. Even so, it was an interesting period in my life precisely because of all the money that was to be had.

During the "Dot Com Explosion" of the late 90's I knew more than a few people who amassed considerable wealth in a very short amount of time. This did not include me, however, because I was becoming increasingly involved with the Buddhist studies I had stumbled upon a decade earlier. Material wealth was something that took a distant back seat to my spiritual wealth back then, so chasing the buckets of money was not a priority. Even so, it was an interesting period in my life precisely because of all the money that was to be had.

And the randomness of where the money went.

Some people I knew stumbled into shit-loads of money almost by accident, but were smart enough to turn it into a personal fortune while the gettin' was good.

One guy... a kid, really... was pulling down thousands of dollars a week just making simple banner ads in his spare time. He not only earned enough money to completely pay for his college tuition, but had enough left over to pay for a bug chunk of his sister's education as well.

Another guy got a full-time job with a massive salary working from home on a corporate website. This occupied so little of his time that he ended up getting two additional "full-time" work-at-home-jobs... all of which he held at the same time. After six months he had enough money saved up that he started his own business, which he ran successfully for nearly a year before selling it for a staggering amount of money. This would be a cool story in itself, but it's made all the more incredible when you know that he kept all three of his "full-time" jobs that whole time!

Still another guy made huge, huge money because he owned a "worthless" low-rent office building that his family had purchased decades earlier. He inherited it after his dad died and had tried to sell it several times without success... until the neighborhood became a hotspot for dot-com start-ups. Luckily for him, he quickly learned the value of what he had, and was able to milk it for incredible profits... before finally selling it to a big company that bought it only so they could tear it down and build their new headquarters on the land.

Money was raining down from the heavens at an incalculable rate, and a lot of people became incredibly wealthy chasing it.

But not everybody.

Some people, try as they might, could never manage to get their piece of the pie no matter how hard they tried. They would start up one failed business after another trying to figure out where the money was... but never managed to find it.

These were some of the most bitter, angry, resentful people I've ever met. And the most educational, as they clearly confirmed that my embracing anti-materialism was the right path to be on. This was never made more clear to me as when I joined a group of them at a housewarming party thrown by a guy who was making bajillions of dollars in dot-com cash. He proudly showed off his incredible new home, only to be cut-up from one end to the other the minute he left the room. At one point some guests were discussing the "horror story" that was the kitchen decor. I found this funny... and said so, which lead to this conversation...

"You actually like that ugly mess?"

"Well, it's not my taste, but he's clearly happy with it. Since he's the one that has to live with it, what should it matter to anybody else?"

"Because he has the money to hire a decent interior decorator and still chooses to have an ugly kitchen!"

This was good for a group-laugh, which was fascinating to me...

"Well, fortunately the only thing wrong with him is something that can be fixed by a coat of paint... we should all be so lucky."

The implication of that statement went right over their heads (thankfully), but stuck with me for a very long time. Even when I strayed off the path of anti-materialism because I realized that some "stuff" made my life much more fun. Like a

Eventually the dot-com bubble burst. Some people who made a lot of money ended up losing a lot more.

This, I'm sure, was a time of glee and much rejoicing by all the bitter, angry, resentful people who were so tortured by the monetary success that eluded them during those heady days. Finally, at long last, those who succeeded where they had failed were "getting what they deserved!"

The irony being that all the bitter, angry, resentful people were getting exactly what they deserved, even if they didn't realize it.

...

Which is why I am trying hard — so very hard — not to be bitter, angry, and resentful that Justin Bieber's new album, Believe, has just become the year's top-selling debut... despite being filled with songs that I loathe so badly that I can barely listen to 10 seconds of the 90-second preview snippets on the iTunes Store without gagging.

Fortunately, Matt & Kim, a band I love more than buckets of money, just released a new single to keep me on my path...

Life. Is. Good.

This is one of those times where every cent of my paycheck was already spoken for.

This is one of those times where every cent of my paycheck was already spoken for.

Which would usually be upsetting, but it's a direct result of spending a week goofing off in Europe after having just gotten back from two weeks vacation, so I'm perfectly okay with it.

Even so, you can imagine my excitement as I was rearranging books on my shelves only to have a 1000 Korean Won note fell to the floor. It had apparently been used as a bookmark. Or maybe I just stuck it between some books because it was pretty and I wanted to flatten it out for a souvenir...

However it got there, the only thing running through my mind now was... MONEY!

But how much? Maybe $20... probably more like $10... but wouldn't it be cool if it was $100? I had no idea, so I rushed to fire up a currency conversion app on my iPhone.

Only to discover that 1000 Won is 89¢ in US money. Which, coincidentally enough, is almost exactly the same as when I was last in Seoul back in September 2004. That's not as good as the $1.10 I would have gotten in November of 2007... but certainly not as bad as the 64¢ I would have got back in March of 2009.

In any event, whether it's $1.10 or 89¢ or 64¢, that doesn't do much for my cash on hand. Especially once exchange fees are paid.

Thank heavens for credit cards, because it's time to shop.

With the exception of grocery stores, it's getting to the point where I rarely shop at brick-n-mortar stores any more. Everything I need to buy is purchased off the internets. But I got a $10 coupon back when I paid for my eye exam at Shopko (where everything is always on sale!) and it's expiring today, so I decided to stop in and see if I could spend the $50 required to use my coupon. Sure I'm poor just now, but you gotta spend money to save money!

I ended up buying new bed sheets (on sale!) and a PUR water filtration pitcher (on sale!). This was just enough to get my $10 savings, so I was pretty happy.

Until...

Just for kicks, I checked pricing when I got home... only to find that even with the $10 coupon, I ended up paying $1.30 more than if I had bought online (and that includes shipping!). Add in money for gas and my time and I definitely lost-out on the deal.

Oh well. Live and learn.

But I'm pretty sure I learned that already.

Nothing quite like losing 15% of your retirement fund in less than two months. So happy I pay a bunch of experts to manage my money! Something tells me I would have been better off investing my money in hookers. Sure it uses my long-term asset for a short-term investment with no long-term payoff... and comes with some really heavy risk factors... but at least I would be stimulating the local economy.

Nothing quite like losing 15% of your retirement fund in less than two months. So happy I pay a bunch of experts to manage my money! Something tells me I would have been better off investing my money in hookers. Sure it uses my long-term asset for a short-term investment with no long-term payoff... and comes with some really heavy risk factors... but at least I would be stimulating the local economy.

And my penis.

What's odd is that my retirement plan is fairly low-risk. I can't imagine how much I would have lost were I still in the high-risk/high-yield program I was in just five years ago.

And don't think I'm not grateful that I at least have something left in my retirement account. There are many, many people out there who are not so lucky. Stupid economy.

So, yeah, I'm a little worried about my retirement.

But that's quite a ways away. And, as of today, is even further away than it was last month.

The more immediate concern is my upcoming vacation. I haven't worked out all the details yet, but if the US dollar gets much worse, my travels are going to take a turn for the worse...

On the other hand, I would be meeting new and interesting people.